Green Street, a leading provider of commercial real estate intelligence across the U.S., Canada, and Europe, has launched Retail Analytics Pro, a new suite of data and analytics tools aimed at transforming investment decisions in the UK retail sector.

The new platform offers in-depth property-level insights for High Streets, Retail Parks, Shopping Centres, and Outlet Centres, making previously hard-to-access data available to investors. Green Street’s initiative reflects the renewed interest in the UK retail market following its recovery from a challenging period.

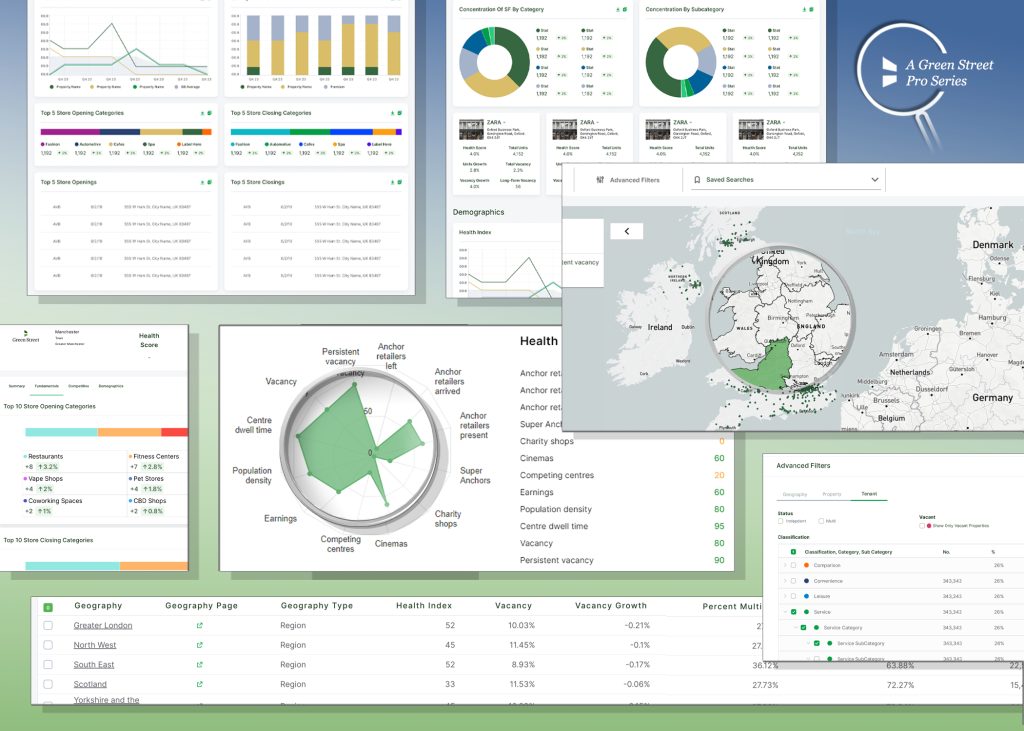

Retail Analytics Pro integrates detailed information on over 700,000 UK retail properties, offering users real-time data and analytics. This includes historical vacancy trends spanning more than a decade. The platform was designed to help both direct and indirect investors and occupiers make informed decisions, supporting their portfolio optimisation strategies and leasing plans.

The development follows Green Street’s acquisition of the Local Data Company, whose property-level data has now been enhanced with new analytics features. Key enhancements include a health index based on real-time insights, macroeconomic data, and demographic forecasting. The platform also provides support for monitoring tenant activity and risks, alongside comprehensive population forecasts and forward-looking metrics on housing growth.

Rob Virdee, Senior Analyst at Green Street specialising in the retail sector, remarked that the platform’s launch comes at a time when UK retail is seeing heightened interest from investors. “The UK retail sector has navigated its existential crisis and is back in focus for investment committees. Investor appetite is increasing, and the Retail Analytics Pro product suite is a response to client demand for high-quality, granular data,” Virdee explained.

He acknowledged that underwriting at an asset level remains challenging, but added that this complexity offers potential for higher returns for investors willing to take a data-driven approach.

John Guilfoy, Chief Product Officer at Green Street, highlighted the significance of the launch for the global real estate community. “Retail Analytics Pro seamlessly integrates detailed UK property-level data with Green Street’s renowned analytics capabilities. This launch marks a key milestone in our commitment to delivering ever-improving analytics to better serve our clients in an evolving market.”

In addition to the platform’s advanced data features, Green Street plans to publish sector research driven by its well-regarded valuation framework. This research will focus on risk-adjusted returns, aimed at helping investors make better capital allocation decisions.

The platform also offers enhanced reporting tools covering all major retail formats in the UK. It allows for competitor tracking at a local level, with 10 years of historical data available to support strategic planning. This includes tracking occupancy, tenant movements, and market risks across all types of retail properties.

As the UK retail market continues its recovery, Retail Analytics Pro is set to provide investors with the actionable insights needed to navigate an increasingly complex landscape and maximise their investment returns. To explore Green Street’s Retail Analytics Pro and our new product’s different offerings, visit the Green Street Retail Analytics Pro website to learn more.